AÑO

2021

CATEGORÍA

Comunidad

OBJETIVOS

Trabajo decente y crecimiento económico

PAL. CLAVE

digital banking, Mobile banking, millenials, Credit worthiness , financial services

PAÍS

United States of America

CRÉDITOS

Yumeng Ji, Andrea Kang, Ke Hu

LINK

https://medium.com/@yji6/chase-farro-31f7d18f8822

Chase Farro

Checking accounts for millenials

In 2017, roughly 17% of millennials in the U.S, were institution unbanked — they have neither a checking nor a savings accounts with a bank, credit union or savings & loan institution.

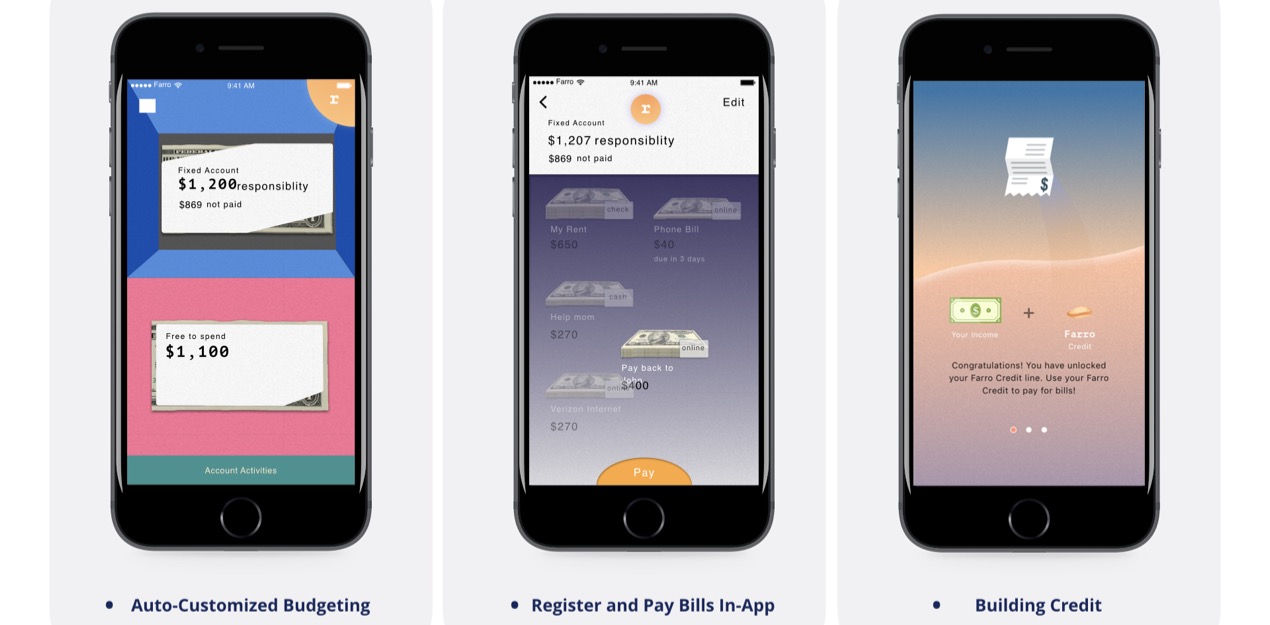

Farro is a unique checking account that features smart bill payment and a built-in credit growth system to help users improve their financial capability over time.

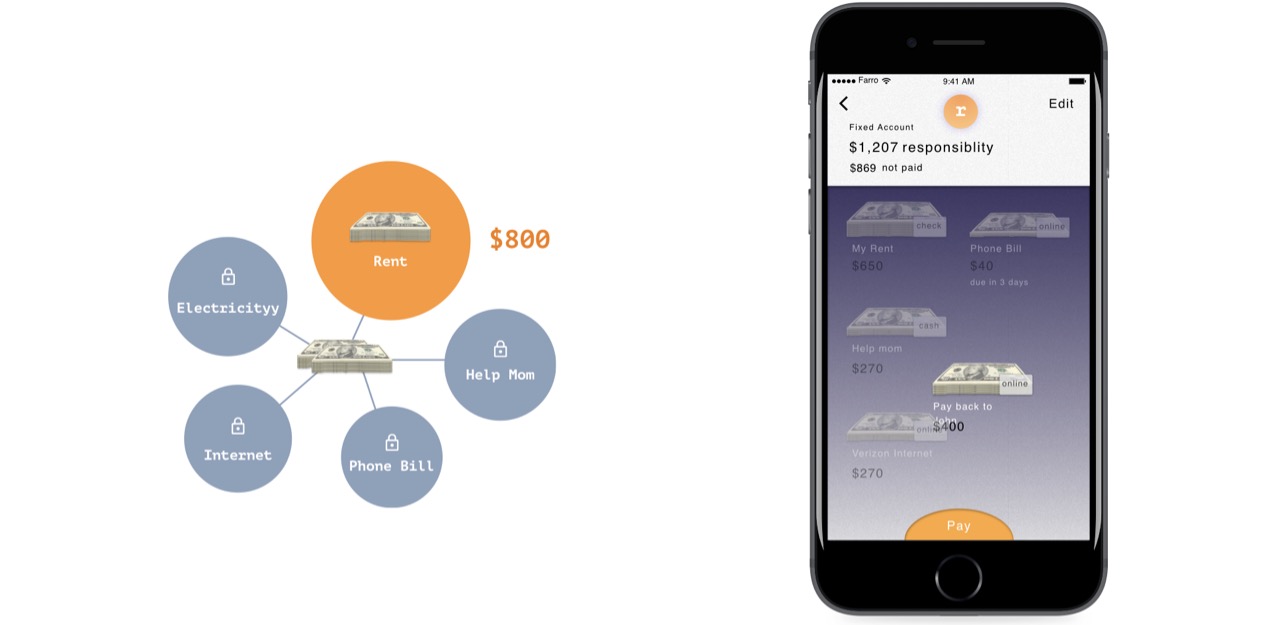

Users can divide their checking funds between two buckets: a “Fixed Amount” and a “Free to Spend.” Users create their “Fixed Amount” by registering their monthly bills. This allows them to see progress towards paying bills vs. how much they can spend. With Farro, users can connect bills like rent, utilities, or phone bills and pay directly inside the app, When users locked enough money the bucket, user can pay it directly through Farro — saving time, effort and money. Once a user pays their registered bills on time and in full for 6 consecutive months, they are offered Farro credit limited to the total amount of their bills.